New Bills Address Our Concerns

The news on this page affects you and me, our homes, our taxes, our costs for insurance, and it is happening right now! Four Assembly Bills and one Senate Bill!

Legislation is underway to address complaints about . . .

- Rising home insurance costs and inability to get coverage in wildfire areas.

- High costs for hardening homes against wildfire and making defensible space around our homes

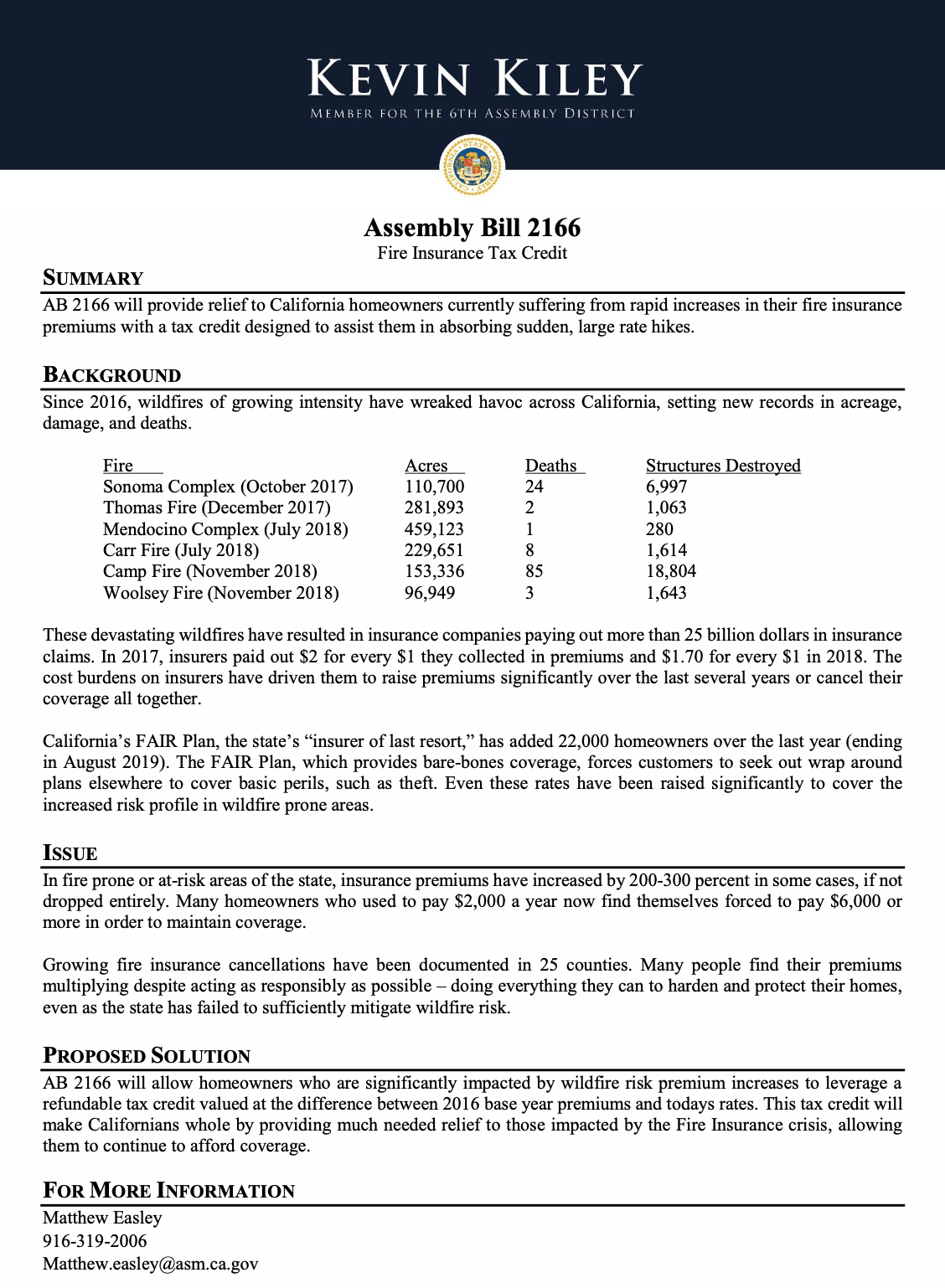

Tax Rebate for Increased Insurance Fees

Assembly Bill 2166 (AB2166) is working its way through the assembly and proposes a refundable tax credit which would be the difference between the 2016 base year premiums and today's rates. Since this is a very important bill to many in our community, we are placing Assemblyman Kevin Kiley's explanation of the bill below this paragraph. But please be sure to read on below the explanation -- there is much more news about Assembly actions:

Residential Property Insurance and Wildfire Resilience

Assaembly Bill 2367 establishes the Wildfire Resilience Task Force which we will likely be hearing a great deal about in the future. The Task Force will develop minimum standards for determining whether a residence is fire-hardened and minimum standards for determining whether a community is fire-hardened. In addition, the Task Force may develop regulations to require insurers to incentivize wildfire mitigation by homeowners in their insurance premiums.

XXXXXXXXXXXXXXX Just got this new link about AB 2367. XXXXXXXXXXXXXXX

Fire Resilience Disclosure when Selling Your Home

An Assembly bill was passed last year to develop standards requiring residents in wildfire areas to make a fire resilience disclosure when selling their homes. However, development of the standards is not complete.

Funds to Retrofit Your Home

Assembly Bill 38 was passed in October of 2019. It establishes a 5-year pilot program using a wide range of potential funding to help communities and owners of homes built prior to updated building codes in 2008 to harden their homes against wildfires. As yet, agencies have not enacted policy to make AB38 a reality.

Yet Another Bill Proposes Funds for Retrofitting Homes

Under Senate Bill 944, homeowners making less than $70,000 annually ($140,000 for a couple) would qualify for the tax credit for home hardening projects with the primary purpose of protection from wildfire.

Read Senator McGuire's Description of SB 944